Core viewpoint: From the supply side, domestic steel products are affected by the adjustment of the “carbon neutral” strategic policy, which will restrict domestic steel production in the medium and long term. In the short term, Tangshan and Shandong environmental protection will restrict production, restrain the start of steel plants, and the overall output will remain relatively stable; the demand side will continue Maintained at a relatively high level, while demand growth is still rising, downstream consumption is relatively active; total steel inventory continues to be de-stocked. As downstream consumption increases and exceeds output, while output is relatively stable, inventory has accelerated decline. The overall strong fundamentals have strong support for steel prices. In addition, internationally, steel prices in major economies in the world are all showing an accelerated upward trend. The price gap between China and the United States continues to widen, exceeding the high level in recent years. The repair of the price gap is expected to drive domestic steel prices to continue to rise. On the whole, steel prices are likely to rise but not fall in the market outlook, and the probability of continued fluctuations is higher.

Strategy: Do more hot coils and threads on dips

Risk points: domestic monetary policy is tightened, environmental protection and production restrictions are not implemented as expected

1. Domestic steel operating rate

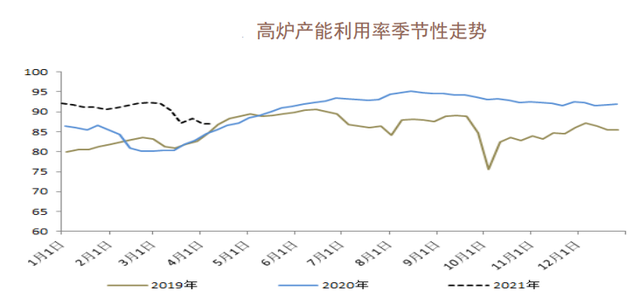

From the perspective of seasonal performance, the current domestic blast furnace operating rate is at a high level in the same period of the last three years. However, since March, the operating rate of blast furnaces has declined and is currently stable. Short-process operations are also at a high level in the same period of six years. There are signs of further improvement. Judging from the seasonal performance, short-flow operations generally reach a high level in May, and then steadily fluctuate to a lower level. On the whole, the marginal change of the current operating rate to the increase in steel production is relatively limited, and the pressure on the supply side is relatively slow.

2. Domestic steel inventory

Judging from the inventory data of threads and hot coils, the current total thread inventory is relatively high in the same period of the last six years, which is lower than last year and higher than other years. In terms of seasonal performance, the inventory peaked around March, and until now it has begun to show a state of destocking. Among them, the hot coil inventory is relatively weaker than the thread. The current inventory has fallen to the level of the same period in 2018, and the inventory decline has not slowed down. sign. On the whole, the continued decline in inventories still provides strong support for short-term steel prices.

3. Apparent consumption of domestic steel

From the perspective of consumption, the current consumption of threaded and hot coils has remained at a high level in the same period in the past six years, and there is still a trend of continuous increase. From the perspective of seasonal continuity, the peak consumption of threaded and hot coils generally lasted around May in previous years. Compared with the current time point, there is still a period of high-speed consumption for about a month in the later period, during which there is also a strong support for the price of steel.

Post time: Apr-13-2021